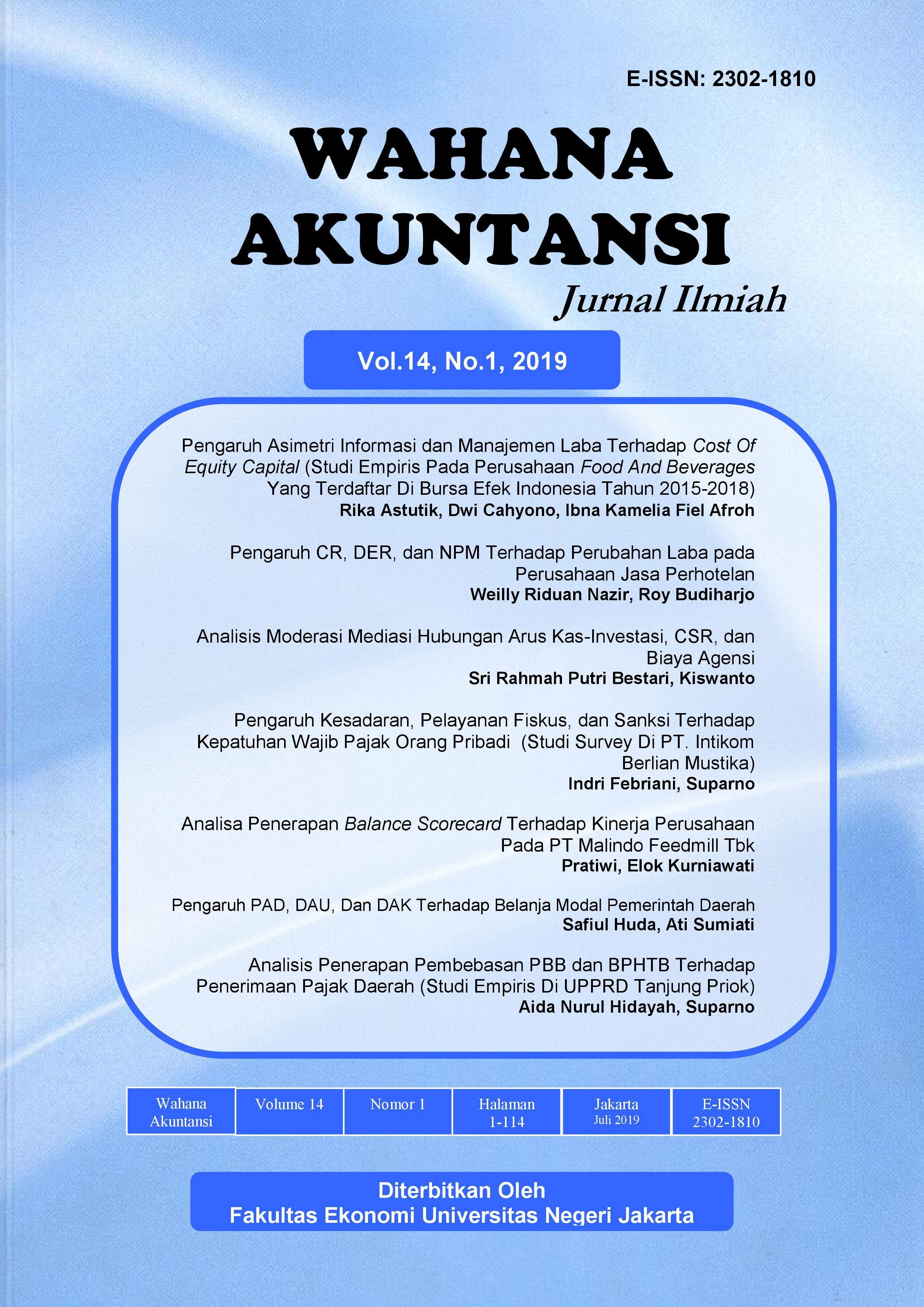

ANALISIS PENERAPAN PEMBEBASAN PBB DAN BPHTB TERHADAP PENERIMAAN PAJAK DAERAH (Studi Empiris di UPPRD Tanjung Priok)

Abstract

This study aims to analyze the effect of applying Governor Regulation No. 259 of 2015 concerning exemption from Building Land Taxes and Governor Regulation No. 126 of 2017 concerning the exemption of BPHTB from the Regional Tax revenues of the DKI Jakarta Province. The data used is a report on local tax revenues in the Tanjung Priok District in 2013-2015. There are 2 independent variables, namely the application of Governor Regulation No. 259 of 2015 and Governor Regulation No. 126 of 2017. This research shows that the application exemption from Building Land Taxes and BPHTB influence to Local Tax Revenue.

Jurnal Ilmiah Wahana Akuntansi is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

Articles in Jurnal Ilmiah Wahana Akuntansi are Open Access articles published under the Creative Commons CC BY-NC-SA License. This license permits use, distribution and reproduction in any medium for non-commercial purposes only, provided the original work and source is properly cited. Any derivative of the original must be distributed under the same license as the original.